Setting financial goals is one of the most impactful steps you can take to improve your money management and overall financial health. Goals provide clarity, motivation, and direction, helping you prioritize what truly matters and avoid financial pitfalls. However, the process of tracking and maintaining these goals can often feel overwhelming.

That’s where smarter approaches to personal finance tracking come in. By focusing on the bigger picture instead of obsessing over every detail, you can stay motivated without unnecessary stress. Tools like Emberist allow you to consolidate your financial accounts in one place, simplifying goal tracking and letting you focus on progress rather than perfection.

In this guide, we’ll explore how to set effective financial goals, why tracking them matters, and how tools designed for modern lifestyles can make financial success more attainable.

Why Financial Goals Are a Game-Changer

How Goals Help You Master Your Money

Financial goals provide direction and purpose, turning vague aspirations into actionable plans. Here’s why they matter:

- Purpose: All your money has a role, whether saving, investing, or mindful spending.

- Motivation: Clear goals help you stay disciplined, even during tough times.

- Control: Goals reduce financial anxiety by clarifying your priorities.

Types of Financial Goals You Should Consider

- Short-term: Building an emergency fund, saving for a vacation, or cutting unnecessary subscriptions.

- Medium-term: Paying off credit card debt or saving for a significant purchase like a car.

- Long-term: Building a retirement fund, investing for financial independence, or buying a home.

How to Create Financial Goals That Stick

Start with Your Vision

Ask yourself:

- What financial milestones are most important to you?

- How will achieving these goals improve your life?

Clearly defining your “why” ensures your goals are meaningful and motivating.

Apply the SMART Framework

Make your financial goals:

- Specific: Define exactly what you want to achieve, e.g., “Save $10,000 for a home down payment.”

- Measurable: Track progress regularly to stay on course.

- Achievable: Set realistic targets based on your current finances.

- Relevant: Align your goals with your priorities and lifestyle.

- Time-bound: Set deadlines to create accountability.

The Role of Tracking in Financial Success

Why Tracking is Essential

Tracking isn’t just about numbers—it keeps you engaged and motivated. Here’s how:

- Clarity: Understand your financial standing at a glance.

- Consistency: Regular updates keep you focused on your goals.

- Momentum: Seeing progress inspires you to keep going.

Celebrate Wins Along the Way

Tracking progress also helps you recognize milestones, such as reaching 50% of a savings goal or significantly reducing debt. Celebrating these moments reinforces good financial habits.

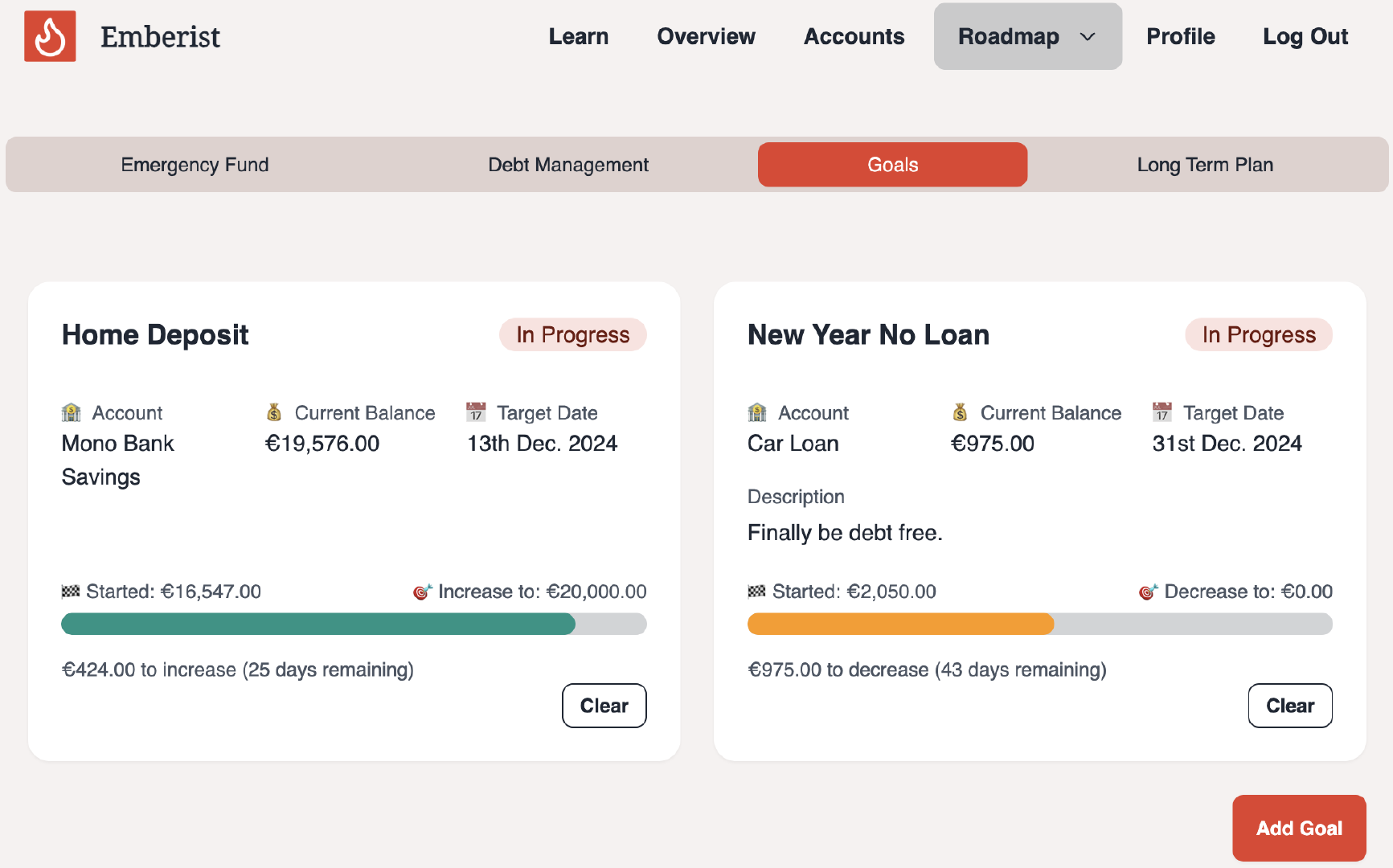

Simplify Goal Tracking with Emberist

Managing financial goals can feel overwhelming, but Emberist makes it easier by linking your accounts directly to your goals. As you update your account balances, your progress is automatically reflected, giving you a clear view of where you stand without the hassle of manual tracking. This streamlined approach helps you focus on achieving your goals instead of getting bogged down in the details.

Staying Consistent: Practical Tips

Set It and Forget It

Automating your savings, debt payments, and investments ensures consistent progress without constant effort.

Regular Check-Ins

Review your finances monthly or quarterly to assess progress and make adjustments as needed. A well-organized dashboard can streamline this process.

Adapt as Necessary

Life is unpredictable. Stay flexible and update your goals when priorities or circumstances change.

Setting and tracking financial goals doesn’t have to be overwhelming. By focusing on what truly matters and using tools that simplify the process, you can build a system that supports financial success without unnecessary stress. Start your journey today by taking the first step toward clarity and consistency.

FAQs

Q1: What makes Emberist different from other financial apps?

Unlike competitors, Emberist focuses on macro-level tracking and lets you link accounts to goals for easy progress updates.

Q2: How does Emberist help with goal tracking?

Emberist allows you to link accounts to specific goals. As you update your accounts, your goal progress is automatically reflected.

Q3: Can Emberist handle complex financial goals?

Yes! Emberist’s flexible system is designed to accommodate both simple and complex goals, adapting to your needs.

Q4: Is Emberist suitable for people with busy schedules?

Absolutely. Emberist’s linked account approach and intuitive interface make it perfect for anyone looking to manage finances efficiently.

Q5: How can I get started with Emberist?

Visit Emberist to create your account and begin simplifying your financial life today.